We offer cutting-edge solutions for customer management and payment processing. Our comprehensive system integrates advanced AI and machine learning capabilities to revolutionize the way businesses handle customer relationships, streamline payment processes, and mitigate financial risks. With TradeHive, businesses can efficiently manage customer accounts, accept payments through various channels, and leverage AI algorithms to identify potential bad debts or late payers. Let’s explore how TradeHive transforms customer management and payment processing to drive business growth.

Streamlined Customer Management

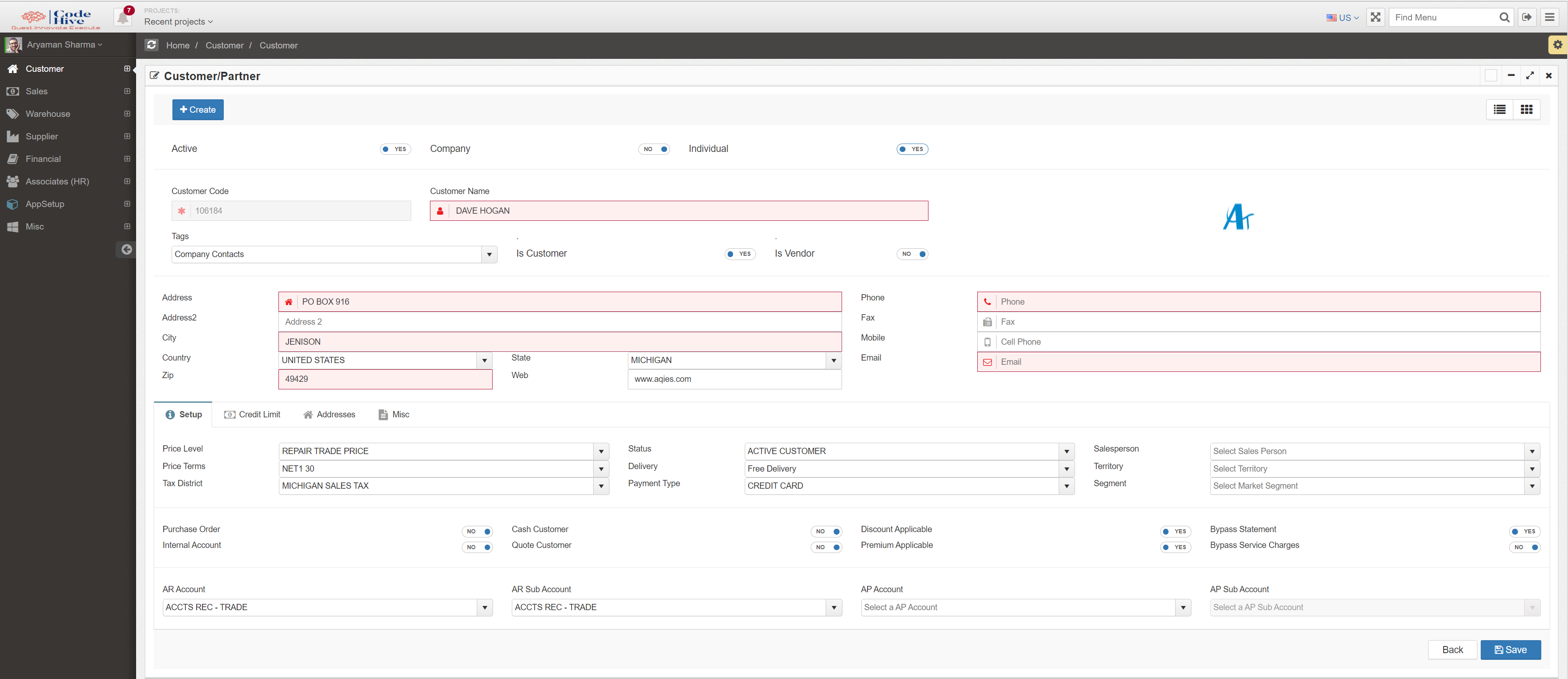

TradeHive provides a centralized platform to manage customer accounts effectively. The system allows businesses to maintain a comprehensive database of customer information, including contact details, purchase history, credit limits, and payment terms. By consolidating customer data, TradeHive enables businesses to have a holistic view of their customers, facilitating personalized communication, targeted marketing campaigns, and enhanced customer service.

Diverse Payment Processing Options

TradeHive offers a range of payment processing options, allowing businesses to cater to diverse customer preferences. The system seamlessly integrates with online payment gateways, enabling customers to make payments securely and conveniently through credit cards, debit cards, or other digital payment methods. Additionally, TradeHive supports Automated Clearing House (ACH) payments, enabling customers to authorize direct bank transfers for seamless transactions. For customers preferring traditional methods, TradeHive facilitates check payments and provides features to streamline check processing.

Credit Limit Monitoring and Risk Mitigation

TradeHive’s intelligent credit management module ensures businesses have full control over credit limits and proactively monitors customer creditworthiness. The system raises flags for customers approaching or exceeding their credit limits, enabling businesses to take necessary actions, such as setting temporary credit holds or requesting updated financial information. By leveraging AI and machine learning algorithms, TradeHive analyzes historical data, payment patterns, and customer behavior to identify potential bad debts or late payers. This proactive approach allows businesses to minimize financial risks and maintain a healthy cash flow.

Accounts Receivable (AR) Module

TradeHive’s AR module empowers businesses to track payment patterns and effectively manage outstanding balances. The system provides real-time insights into customer payment histories, aging reports, and invoice status, allowing businesses to identify trends, monitor delinquent accounts, and take appropriate actions to ensure timely payment. AI and machine learning algorithms in TradeHive’s AR module analyze customer payment behavior and identify patterns associated with late payments or potential bad debts. This enables businesses to develop targeted strategies to mitigate risks, negotiate payment terms, or implement credit collection measures.

AI-Driven Decision-Making

TradeHive leverages the power of AI and machine learning to drive intelligent decision-making in customer management and payment processing. By analyzing vast amounts of data, including customer information, payment histories, and credit risk factors, TradeHive’s AI algorithms provide valuable insights and predictive analytics. This allows businesses to identify high-risk customers, optimize credit terms, and develop strategies to enhance collections and customer relationships. The AI-driven approach ensures businesses make informed decisions, reduce financial risks, and optimize their cash flow.

Advanced Reporting and Analytics

TradeHive’s reporting and analytics capabilities empower businesses to gain deep insights into customer behavior, payment trends, and overall financial performance. Through customizable dashboards and reports, businesses can monitor key performance indicators, track customer payment patterns, and identify areas for improvement. The system provides actionable insights that enable businesses to enhance customer satisfaction, optimize credit management processes, and drive profitability.

TradeHive’s comprehensive customer management and payment processing module is a game-changer for businesses seeking to elevate their financial operations. By leveraging AI-driven solutions, TradeHive enables businesses to efficiently manage customer accounts, accept payments through multiple channels, and mitigate financial risks associated with credit management. The system’s advanced reporting and analytics capabilities provide valuable insights for strategic decision-making and enhance overall business performance. Experience the transformative power of TradeHive’s customer management and payment processing solutions and unlock the potential for seamless financial operations and business growth.